The state of Indiana allows businesses to avail tax saving benefits on utility purchases, provided that the purchased utility is directly used in the production of a tangible property produced with the intention of selling. Yet, many businesses fail to use these offered tax exemption benefits, overpaying in the process.

According to a survey, companies frequently overpay in sales and use taxes, with the manufacturing industry found most guilty for exercising the negligence.

The reasons are many. Some fail to identify the areas where money could potentially be saved. Others are not able to make a strong case for their eligibility. Then there are some who don’t know how to apply for utility sales tax exemption.

In this blog, we aim to focus on the basics. We guide you through the sales tax exemption application process.

First Things First…

You will need to conduct a complete utility study of your production facility. A utility study provides a complete breakdown of your energy usage on a per meter basis, identifying areas which qualify for tax exemptions.

A utility study may or may not be required with an application, but conducting one allows you to structure your application better. Hire a utility tax consultant in Indiana for tailored guidance.

Fill Out the ST-200 Form

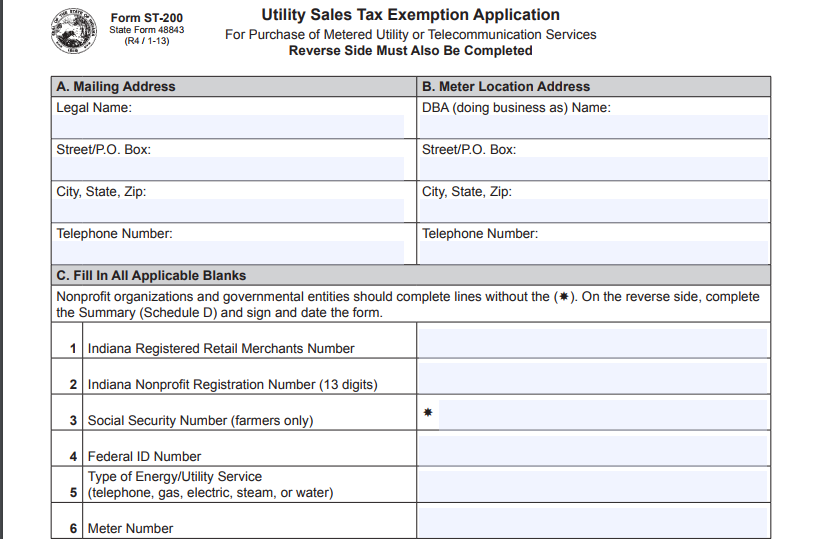

Once you have performed a utility study, your next step would be to fill out the utility sales tax exemption application form. This form is also called ST-200 form. You can download it by clicking here.

Read the instructions on the form carefully and then fill the blank fields. A separate application should be made for each meter. Apply using the legal name of your business, and enclose a copy of the utility bill with your application form to speed up the review process. Also, attach the utility study with the form to help the DOR staff with the assessment process.

Sign and date your application form and go through it one last time to ensure all the required details have been furnished. Incomplete information can lead to the delay in the processing of your exemption application.

Post the application form to the address below:

INDIANA DEPARTMENT OF REVENUE, COMPLIANCE DIVISION, UTILITY REFUND SECTION, 100 NORTH SENATE AVENUE ROOM N203, INDIANAPOLIS, IN

On the Approval of the Application

Once your application has been approved, you will be issued an ST-109 certificate, declaring that you are now exempted from the payment of utility sales tax. Keep that certificate safe for future reference.

And there you have it, this is how easily you can file for utility sales tax exemption in Indiana.

Got any questions about ST-200 form or the application process in general? Feel free to reach out and our expert utility tax consultants will be happy to serve you.